Today’s Va refinance rates of interest

To possess today, Friday, , the brand new national mediocre 29-12 months Virtual assistant re-finance interest rate is six.51%, down than the last week’s rates out of 6.56%. Virtual assistant re-finance rates enjoys trended a little down while the fall out of 2023, which have prices expected to consistently lose during the 2024. Va finance commonly hold all the way down cost when comparing to its old-fashioned equivalents.

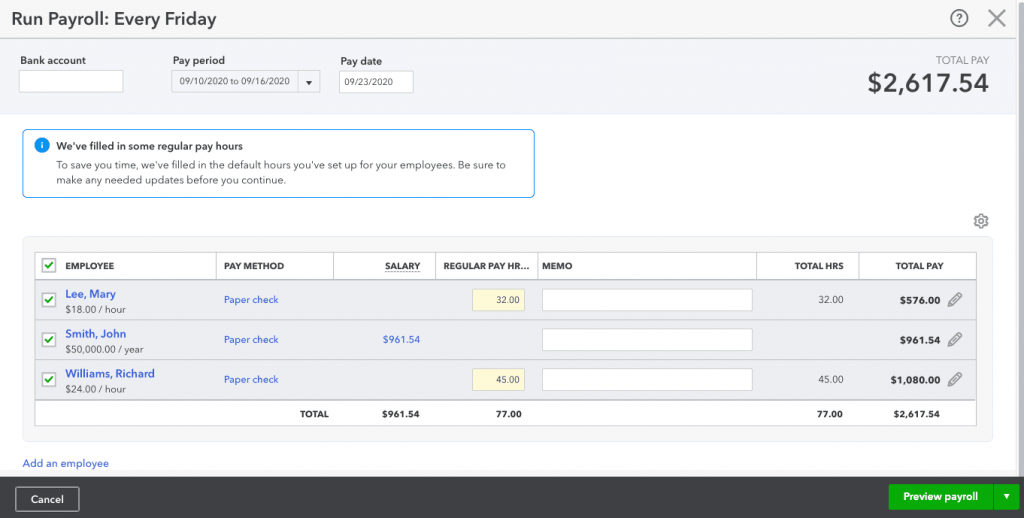

Brand new dining table lower than combines an extensive federal questionnaire regarding home loan loan providers in order to find out the most competitive Va refinance mortgage rates. Which desk is updated each day to convey the most latest interest rates and you can APRs whenever choosing good Virtual assistant home mortgage refinance loan.

National re-finance cost by loan variety of

- Buy

- Re-finance

How Bankrate’s prices was calculated

- Straight away averages: I assess every single day right-away rate averages to the some activities away from multiple loan providers. We gather this type of APRs immediately following romantic out-of organization, and additionally they echo the last day of prices considering a borrower which have an effective 740 FICO credit rating and an enthusiastic 80 per cent loan-to-value (LTV) proportion purchasing an existing, single-relatives number one household.

- Bankrate Display (BRM) rate averages: Every week, i together with https://paydayloanalabama.com/bay-minette/ assemble APRs on the ten largest banks and you may thrifts within the 10 of the most important You.S. markets. For those averages, we guess a borrower with an excellent 700 FICO credit rating (740 if the a low-compliant financing) and you will an enthusiastic 80 per cent mortgage-to-really worth (LTV) proportion, among almost every other requirements.

The right-away and you may Bankrate Screen averages derive from no established relationship or automatic money. Learn more about the speed averages, article advice and how we profit.

Bankrate’s mortgage rates dining table shows projected home loan rates off other Va lenders, designed for your requirements. Additional Virtual assistant loan providers charge additional prices and you can costs, so it you may shell out to look to. For custom rates, submit the brand new sphere more than since correctly that you can. Remember, regardless if, speaking of rates; the actual price relies upon plenty of activities.

What is an effective Virtual assistant financial refinance loan?

Virtual assistant refinancing a mortgage are an alternative accessible to eligible effective-responsibility provider members, pros and surviving spouses. For people who meet the requirements, you can re-finance an existing financial, possibly a normal or other Virtual assistant financing, on one of many version of Virtual assistant refinance loans.

Types of Va re-finance funds

- Virtual assistant streamline re-finance: Often referred to as mortgage Prevention Refinance mortgage (IRRRL, noticable earl), these types of Va re-finance has no need for an appraisal or credit glance at. This really is a good option for Va consumers who require to re-finance so you’re able to a reduced rate.

- Va bucks-aside refinance: That have an excellent Va dollars-away re-finance, you could potentially refinance your current financial – regardless should it be good Virtual assistant loan or traditional financing – and get cash from the borrowing from the bank up against your own home’s equity.

Exactly who qualifies to have an excellent Va home mortgage refinance loan?

To help you be eligible for any Va loan, you will have to see particular armed forces provider conditions and now have a beneficial Virtual assistant certificate off qualifications (COE). This service membership requirements are listed below:

- You will be currently on the effective armed forces duty or a veteran who was honorably released and you may found the minimum solution conditions;

- You served no less than 90 straight productive weeks during the wartime or at the very least 181 straight days of energetic solution through the peacetime; or

- You served for over half a dozen age regarding National Shield otherwise Choosy Reserve.

With regards to the version of Virtual assistant re-finance you’re after, there may be additional requirements. Virtual assistant streamline refinances don’t need some underwriting verifications, however you must confirm that you are living otherwise existed on the property. Va bucks-away refinances, additionally, are merely desired towards the an initial household you already live in, and you can demand borrowing and other underwriting conditions.