A unique strain of lenders try providing people generate dollars proposes to get households. Dollars even offers hold clout and you will vendors will accept all of them more than also offers regarding individuals who you need home financing.

Today, it used to be just wealthy anyone and buyers had the money to pull one to from, however perchance you can also be as well. NPR’s Chris Arnold records.

CHRIS ARNOLD, BYLINE: Nicole Howson and her companion spent brand new pandemic cooped right up into the a small rental flat with the a few students, so they decided it was time to order a property.

Religious WALLACE: Customers, when they’re going to the fresh new dining table having a profit give, he could be 4 times very likely to win brand new bid on new home which they need

ARNOLD: But she read over the materials, plus it works out its a real matter. What are you doing is that in the one fourth of all sales today is bucks, and this throws anyone else really missing out as it can certainly just take lengthy to endure the whole mortgage underwriting procedure, score an assessment. One thing can be break down. That is why manufacturers like men and women bucks offers.

Therefore certain people have come with it develop where it say they are going to purchase the home with dollars and you will wrap-up the fresh new loan part with you after. Tom Willerer is with Opendoor, a new providers which is doing so.

TOM WILLERER: Dollars now offers were traditionally kepted for the couple that may pay for while making a funds offer. And today, you can use all of our bucks in order to straight back their give. Which very democratizes usage of dollars offers.

ARNOLD: Also it support the firms, too. They make profit various methods – antique agent earnings and other fees. As well as the more individuals it assist win offers, the greater number of money they make. Christian Wallace is the manager in charge of the newest bucks render program within Finest a home.

ARNOLD: Nicole Howson claims ahead of she will make the cash offer having Greatest, the organization desired to ensure that she you certainly will extremely manage it and you may qualify for a home loan

ARNOLD: Your family is looking to purchase a place near Atlanta, plus they quote using one that just appeared finest.

HOWSON: I happened to be, such as for instance, hoping for a few weeks. Instance, Goodness, please allow this become you to. And no, that provide didn’t score accepted possibly

ARNOLD: Which means they can inform you they already have the bucks. They don’t need be eligible for a home loan. Howson keeps work attempting to sell makeup and won’t features an excellent larger bunch of cash. Then again she had a different real estate professional having a buddies entitled Top a property, and he asserted that that they had the brand new system who does allow her to create some of those strong bucks has the benefit of too. The business do top their that large heap of money.

HOWSON: To start with, I was skeptical. I happened to be like, so you was informing myself whenever I want our house, all of you are merely going to order it for me personally, and I’m going to spend you straight back? He is such as for instance, yeah. I am talking about, you will find property, you spend the deal, therefore buy it, so we sell it back to you.

ARNOLD: That is a pretty the latest issue. Howson requested their aunt-in-rules, who’s got a realtor, and you can she’d never ever actually observed they.

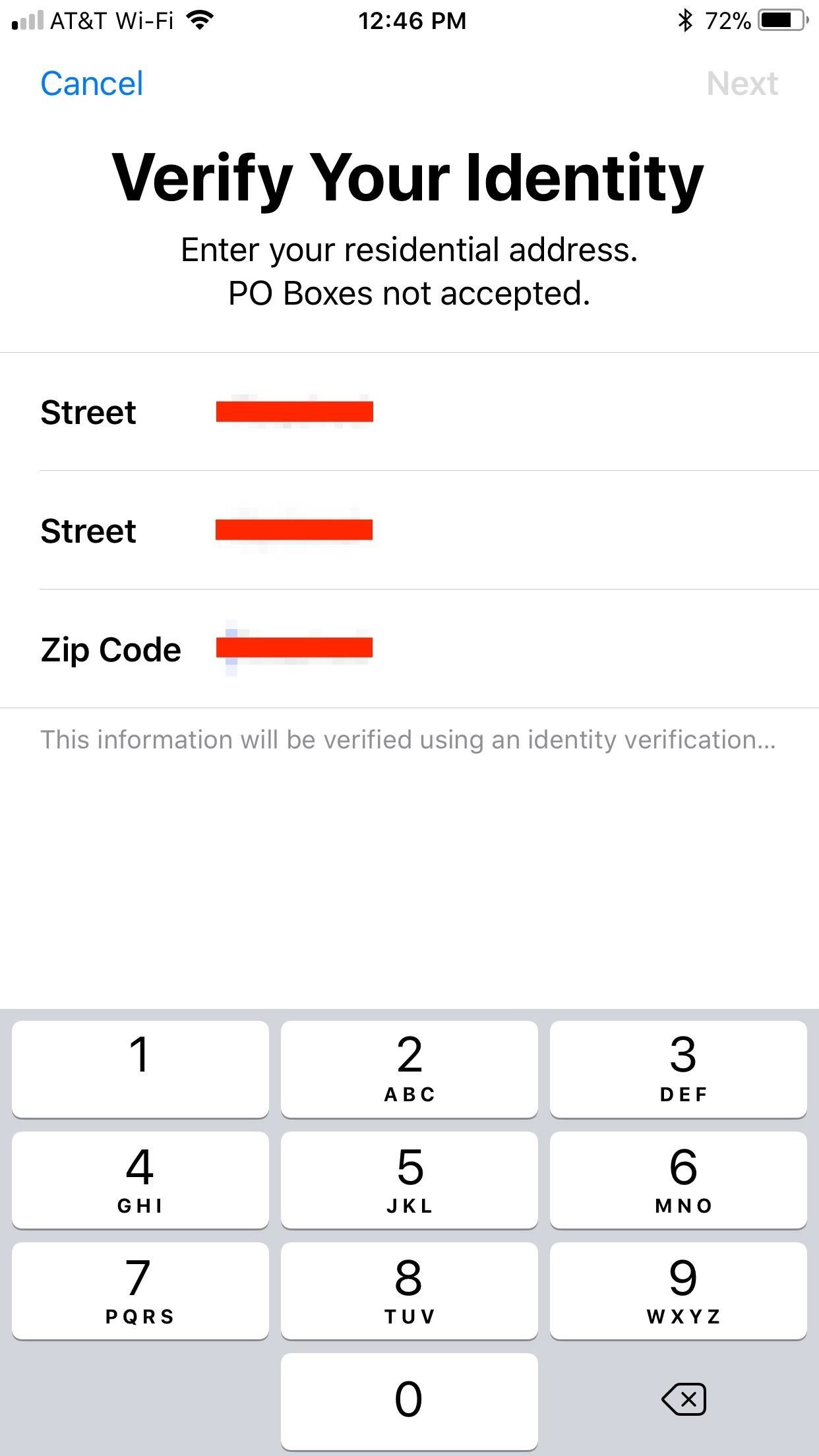

ARNOLD: Nicole installment loans New Hampshire Howson states prior to she can make the cash bring having Best, the organization desired to make certain that she you’ll most afford they and you will be eligible for a mortgage

ARNOLD: Plus the enterprises keeps another type of guardrail in all that it – they won’t allow you to render more than they feel the house is really worth. Shaival Shah ‘s the founder and you can President away from Bend household, an alternate dollars render business.

SHAIVAL SHAH: You will find patterns and you can formulas running regarding record that will expect the worth of our house. Thus same day, everything is totally accepted, prepared to make a cash bring. It is therefore extremely, very, at a fast rate.

HOWSON: This home try the original dollars render which i set up, and it also acquired. And i was such, oh, give thanks to Jesus. It actually was along these lines large lifting weights off of my personal bust. I found myself simply therefore happy; very happy.

ARNOLD: Loans benefits state you definitely should go through the fine printing. Other companies have more costs and you can legislation. However for Howson, she got good mortgage speed and no even more fees. Nowadays, it’s time to start replacement the bathroom and you can home floors.

HOWSON: Yeah. We’ve been carrying out plenty of home improvements, therefore (laughter). But it is like, extremely? Right now you opt to start beating into toilet flooring?

Copyright laws 2021 NPR. All the rights arranged. Check out our web site terms of service and you can permissions profiles on to own more information.

NPR transcripts are formulated on a dash deadline by the an enthusiastic NPR company. So it text message may possibly not be in its final function and may feel updated otherwise revised in the future. Precision and you can availableness ming is the audio number.