Contents

BitMEX also uses multi-signature wallets for traders and holds all physical funds in cold storage. The company keeps its Bitcoin private keys offline instead of a cloud server. A minimum of two employees audit every withdrawal for security and accuracy. Most people trade cryptocurrency on BitMEX using the BitMEX leverage slider.

Bitmex is a P2P cryptocurrencies trading platform established in 2014 by co-founders Arthur Hayes, Ben Delo and Samuel Reed, who have respective backgrounds in finance, trading, and web-development. The holding company HDR Global Trading is registered in Seychelles but also has operational centers in Hong Kong and in the US. It seems that BitMEX has another strategy when it comes to retail customer support compared to other exchanges, they seem to be tying up as little resources in this department as possible. I’m sure it is a different story for institutional or business traders, but unfortunately, it does not provide the best possible support for the average retail trader.

After registering, you must verify your identity by submitting a copy of your photo ID, a presence capture video or photo, location, and a declaration of your citizenship. For small Bitcoin transactions, there are no withdrawal fees or deposit fees. A small fee for Bitcoin Network withdrawals is also charged, but it’s only for transactions made on the blockchain, and not the BitMEX ecosystem. BitMEX Testnet, an independent product, requires a separate registration. BitMEX.com accounts must be registered to create a new account for BitMEX Testnet. Users must also deposit “Testnet Bitcoin” to trade on this testnet.

What Is BitMEX?

However, the company is still not available for use by crypto traders in the country. However, in October 2019, the company slipped up and revealed a thousand user email addresses to its employees in an internal email. While no users were hacked and the platform remained safe, the slip-up is a sign of mismanagement and could potentially lead to a security breach. While it doesn’t come enabled by default, BitMEX offers a two-factor authentication feature, helping you protect your account from unauthorized access.

BitMEX is a leading crypto derivatives exchange that enables traders and investors to buy futures and perpetual swap contracts on a wide range of cryptocurrencies. BitMEX is a market-leading cryptocurrency derivatives exchange that enables traders to buy and sell futures and perpetuals on a range of crypto assets. The exchange’s lack of regulatory compliance and its founders’ criminal charges in the U.S., however, may deter potential users. Coinbase offers no futures trading, while BitMEX is only a futures exchange. Last but not least, any trader should be aware of the advantages with achieving higher trading volumes at bitmex.

BitMEX allows traders to leverage their positions with up to 100x leverage. However, this is not a fixed multiplier but rather a minimum equity requirement. It is determined by the Initial Margin and Maintenance Margin levels. Margin trading and choosing to engage in leveraged activity are risky processes and even more advanced traders can describe the process as a high risk and high reward “game”.

It is easy to get started to trade straight away, which is something I can appreciate. If a single satoshi goes missing or is transferred improperly, the trading engine shuts down immediately. This does not allow for an Mt. Gox type of hack to happen on BitMEX. The reason withdrawal is a little slow at BitMEX is that as mentioned, it is multi-signature which means when withdrawals are made, 2 of 3 parters must sign each withdrawal for it to be executed. BitMEX needs to increase its matching engine scaling efforts to further lower the overload issues, despite it becoming rarer, it still happens more frequently than desired.

Opening a BitMEX Account

Terrible service, few days ago while the market was moving hard, Bitmex was down for some time, and all my orders were executed without being able to access the exchange. This is absolutely unacceptable and i wouldn’t suggest anyone to use bitmex review this exchange any more. The entire point of this “exchange” is to put people up against each other while extracting fees and liquidations from them over time. Check the growth of their ridiculous insurance fund if you do not believe me.

- The Bitcoin conversion of all currency going into and out of BitMEX is both an advantage and a drawback.

- Overall they offer slightly more order functionality than the average exchange.

- A lot of these problems stem from the fact that BitMEX has had immense growth throughout the years, in fact in 2017 alone the exchange experienced staggering volume growth of %.

- Of course, traders using BitMEX can review and monitor their activity at the touch of a button.

- They have no monetary value and are freely distributed via faucets across the Internet.

- Started in 2014 by Arthur Hayes, Samuel Reed, and Den Delo, BitMEX is a Hong Kong-based margin trading exchange.

However, some US customers have worked out their ways to BitMEX via VPN setups, which I should inform you, is prohibited by BitMEX. The company does take measures about the same but those are simply not enough for the impersonators to get in. Currently, BitMEX only supports deposit of BTC cryptocurrencies though you may see different indices. An act of borrowing additional money or cryptocurrency by leveraging the number of cryptocurrencies that you already own to buy additional cryptocurrencies. There has been a fair amount of confusion around theBitMEX cryptocurrency exchange.

Is there a Negative Balance Protection in BitMEX?

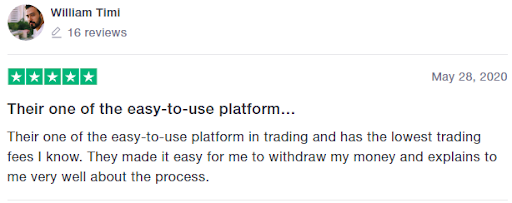

To solve any other issues, BitMEX’s customer support is strong and has been of great use to its investors. The support team knows the obstacles their clients face and suggest the best possible solutions. In this article, we hope to provide you the most updated BitMEX review so you can decide where to trade cryptocurrencies safely.

BitMEX stands out from the crowd by allowing its traders to short the price of the cryptocurrency, basically, to short-sell it. It also offers trades on the future prices of a cryptocurrency through various unique futures contracts. The platform offers the best tools, and an exclusive trading service.

Whatever the platform you use, the first and the foremost step is to create an account to jump into it. Some of the most commonly used exchanges are Coinbase, Binance, Cashapp, BitMex, etc. Once the reigning king of cryptocurrency exchanges has to see itself beat by younger and more innovative and adaptive cryptocurrency exchanges. Despite this, it is able to provide a secure and reliable trading experiences for those not looking for a innovative services or products. The exchange used to be one of the kings when it came to providing highly liquid markets to traders.

Gemini’s product consists of spot trading and investing with 62 coins and 86 trading pairs, while BitMEX’s product focuses on a targeted list of futures trading pairs. Gemini’s fees are typically much higher than those of other exchanges, and BitMEX’s fees are geared more towards active traders and quite low. BitMEX uses a maker-taker fee schedule with tiers for the user’s trailing 30-day USD trading volume. The platform operates a standard trading fee structure across all products for simplicity.

There are no further account tiers at BitMEX, as KYC’d users have full access to exchange services. BitMEX maintains an extensive FAQ and guide to using its margin trading services, and the exchange also provides an API. With that being said, it is absolutely fundamental that you understand the risks that both derivative and leverage trading brings prior to opening an account with BitMEX. On top of keeping the vast bulk of user funds in cold storage, BitMEX also offers a number of additional safeguards. This means that every time you attempt to log in to your account you will be required to enter a unique PIN number that can only be obtained from your mobile phone.

BitMEX Review 2022

In reality, the general consensus is that US citizens do in fact use the platform for their trading endeavours, not least because BitMEX users are able to open an account anonymously. https://broker-review.org/ Even with the platform utilizing IP detection software, US users simply need to install a VPN. Ideal for those who want to leverage on Bitcoin, both buying or selling.

In early 2016, it was handling around 1 million orders per month, and late 2019 it was processing approximately 200 million orders per month. It should come to no surprise then that BitMEX holds the record of amongst major derivative exchanges in daily traded volume. Combined with good volume numbers, BitMEX is considered the most liquid margin exchange for crypto traders. This makes it one of few viable exchanges amongst those who like to trade with a million contracts and more. BitMEX is ranked as the number one crypto derivatives exchange in the world when it comes to open interest, which shows how many contracts have not yet been filled in the order book. BitMEX Academy resources are designed to help people of all experience levels to learn more about cryptocurrency and the exciting world of digital assets.

Plus, there have been no major talks on public forums about its hack or inconsistencies yet. And that’s because very few people know how to margin trade cryptocurrencies and not many reviews are available for the same. Both exchanges offer an Earn feature for users to earn interest on their longer term holdings, however that of Gemini’s is more extensive. BitMEX uses a secure multi-party computation system and a first-of-its kind multisignature deposit and withdrawal scheme.

Launched in 2014 by HDR Global Trading, BitMEX has quickly gained popularity and a reputation as one of the most significant Bitcoin platforms worldwide. In fact, we found that BitMex is supported by almost 200 countries, including the UK, Australia, New Zealand, South Africa and India. The extensive list of countries in which BitMEX can be used makes it a highly suitable choice for traders who travel a lot or may have business interests in other countries.