Content

- Using a cryptocurrency broker

- Justforex became the Best Broker in Asia! What’s next?

- A Cryptocurrency Broker or an Exchange? Which Is Better?

- Safety & Security

- Cryptocurrency Exchanges vs Cryptocurrency Brokers

- Why You Should Consider a Cryptocurrency Broker

- The Top 10 Greatest Stock Market Trades Ever

Numerous crypto exchanges introduce assets that may reduce trading costs. It is worth noting that since crypto exchanges are expanding, they are trying to attract their clients by developing new features. For example, you can find that most known crypto exchanges, such as Binance, Crypto.com, or others, are adding instruments such as DeFi, multiple tokens, contests, NFTs, staking, and other unique tools. Suggest you open a crypto broker account, and we deposit 1,000 USD so we can sell Bitcoin. In case the price of BTC drops, we are benefiting from the difference at which we pull out of the trade. So, once the price drops from 1,000 USD to, let’s say, 600 USD, we take the 400 USD profit thanks to that difference.

Simply put if you want to keep your coins for a longer time, you need to go for the exchange Coinbase, Binance, or any other crypto exchange. If you want to speculate and buy and sell quickly, then you need to go to a crypto broker who offers advisory or brokerage services. When it comes to depositing or withdrawing money from a crypto exchange, you have two options. It is common for debit or credit cards, as well as bank accounts, to be charged fees.

Not only has blockchain technology proven its detractors wrong, but it has found its place in several sectors of business, including travel, medicine, and energy, among others. Bermuda, like the Bahamas, has embraced crypto as the future of finance. Both established frameworks to deal specifically with crypto assets and digital currencies. Both the how to become a cryptocurrency broker Bahamas, with FTX’s bankruptcy, and now Bermuda, with BlockFi’s, face the first significant legal tests of their crypto regulations. Another advantage is that the broker platforms have much more features to offer. Unlike the exchanges, you can put multiple charts in your window, track the quote flow, use indicator sets and other extensions, etc.

Using a cryptocurrency broker

In this article, we shall look into both Crypto brokers and exchanges and help you decide on a better path for your investments. If you’re just looking to buy and hold some cryptocurrencies, then an exchange would be the better option. But if you’re interested in speculative trading, then a broker could be a better fit. Crypto exchanges, on the other hand, have stricter KYC/AML policies in place and are subject to more regulations.

- Check to see that the exchange you intend to trade with is compliant and transparent with its information and operational guidelines.

- Even many major cryptocurrency platforms, including Binance, are frequently targeted by cybercriminals, who are trying to break into their KYC databases, websites, and many other aspects of their operations.

- A good exchange might be limited to certain geographical regions thus limiting your access to it.

- The procedure for an OTC deal typically begins from the primary buyer or seller.

Even the major ones, like Binance, are often targets of scammers and cyber criminals, who attack their KYC database, websites, and many more. A centralized crypto exchange takes full responsibility for the client’s funds. Considering the fact that they handle transactions that might have huge sums, this makes them a highly desirable target for cybercriminals. Whether you choose to use a broker or exchange will be determined by a range of factors including privacy levels, regulatory levels, and fees.

Justforex became the Best Broker in Asia! What’s next?

Nowadays, everyone who knows at least something about finance has heard of cryptocurrencies. In 2017, this industry exploded in popularity, and the crypto market began attracting the attention of more and more traders throughout the world. With extreme volatility and virtually unlimited profit potential, people started going absolutely crazy about it. As a result, a lot of tools, products, and services appeared in the market that opened the door to earning with cryptocurrencies.

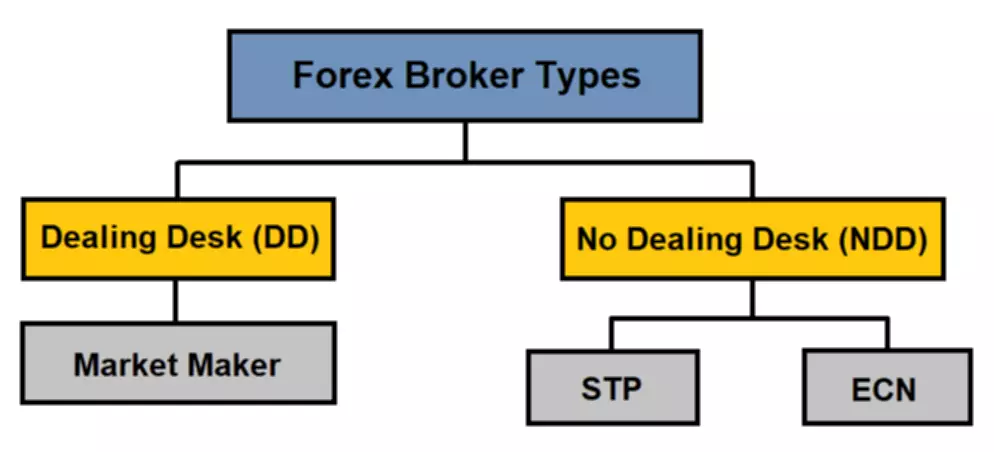

Because cryptocurrencies are still a relatively young business, some individuals may be unaware that there are two methods to trade them. You may accomplish this through an exchange or a cryptocurrency broker, both of which offer certain advantages and disadvantages. In this section, we will look at the differences to help you decide whether it is preferable to trade on an exchange or with a cryptocurrency broker. Cryptos can be traded as CFDs by brokers; however, there are not many crypto assets that can be traded with these brokers. Crypto brokers have the advantage of being regulated by the government, which translates into their creditworthiness and reliability.

What are the basic things you must know when trading over an exchange or a broker? Trading botsOur experts have drawn a list of reliable cryptocurrency trading bot providers, offering high performance at an adequate price. When Celsius, another cryptocurrency loan company, declared bankruptcy in June, it suffered significant damage. Despite claiming to have no direct exposure to the rival, BlockFi reported a rise in customer withdrawals.

Depositing funds to a cryptocurrency exchange can be difficult as they often require users to deposit cryptocurrency. Of course, to do this, they will need to purchase crypto through another exchange or broker and then send it to the new wallet address of the exchange. This requires multiple transactions, orders, and transfers which can result in many additional fees and charges. As always in the world of cryptocurrencies, make sure that you are protecting yourself against scams and money laundering which are both frequent occurrences in the crypto sphere. Bear in mind that a cryptocurrency exchange that ensures high transparency and compliance is also bound to work towards providing users with reliable access and to use state-of-the-art safety measures. Bitpanda Pro holds a PSD2 payment service provider licence and is fully compliant with the provisions of the EU’s fifth anti-money laundering directive .

A Cryptocurrency Broker or an Exchange? Which Is Better?

Therefore, the exchange of fiat currencies and/or cryptocurrencies takes place directly between buyers and sellers, with the exchange operator providing the platform. Cryptocurrency brokers and crypto exchanges are fundamentally different from one another in that exchanges provide a significantly wider scope of cryptocurrencies and other digital assets. You can usually transfer funds either from your crypto wallet or from your debit/credit card instantly, thanks to the ease of digital transactions. If you want to make a deposit, you can do so either with fiat money or with cryptocurrency. In the growing cryptocurrency industry, there are several ways how users can buy, sell, stake, or exchange their digital assets. As of today, the two most popular ways are cryptocurrency exchanges and cryptocurrency brokerages.

Derivatives containing cryptocurrencies may take the form of cryptocurrency futures, crypto options, or trading CFDs. You’ll first select the crypto asset you want to trade, open your trade and then place your desired trade size and price. You can still set automatic buy and sell orders to ensure you don’t have to watch your exchange https://xcritical.com/ platform like a hawk. This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets. If you are looking forward to investing in cryptocurrencies, you must perform your due diligence beforehand. There are two trade modes with a broker or an exchange for trading in cryptocurrencies.

Safety & Security

Our advanced base of ready to use technical solutions are used by a wide range of clients. You may need to wait up to two days for verification to complete. In times of exponential growth, when millions want to join the hype, the exchange might be unable to accommodate new accounts due to high interest and capacity limitations. You may anticipate that registrations and transactions will be more complicated with brokers since they tend to be more official and because they operate on a safer level. In most situations, the brokers are typically the best, withno other party engaged. Swap is the classic trade method for exchanges and is excellent for modest sums of money.

Maybe they’ll purchase some crypto and move it to their very safe hardware wallet. Speculative investors often utilize brokers, who use various TA instruments and techniques such as margin trading to perform multiple transactions. Short- or mid-term gains are what they’re after, and the broker is merely a conduit for getting there. There are no right or wrong answers regarding which is better, but where larger trades are concerned, an OTC desk will probably provide more attractive prices for all parties to the transaction. What you should remember is that as highly volatile assets, cryptocurrencies can bring both quick profits and quick losses. It is important to thoroughly research the companies or exchanges you intend to use when trading cryptocurrencies.

This means that when you trade with a broker, you’re speculating on the price of a currency pair, rather than actually buying and selling the underlying currencies. Many people don’t know about the two methods to trade cryptocurrencies because it’s such a new field. You may use a cryptocurrency exchange or a cryptocurrency broker to do this, but there are a few key distinctions between the two. Even blockchain specialists may be unsure of the distinctions between these two alternatives.

Brokers, on the other hand, usually have much better customer support. This is because they’re typically large financial institutions with dedicated customer support teams. This might sounds like a good thing, but it’s actually quite risky. That’s because if the market moves against you, you can easily lose all your capital. Instead, they match you up with someone who wants to buy or sell the same coin that you do. None of the information you read on Crypto Adventure should be taken as investment advice.

The liquidity of the relatively limited depth of the market attracts traders to cryptocurrency exchanges, which have a broad spread for the many other trading pairs. Trading, withdrawals, and deposits are all subject to additional costs if you use them. However, a broker’s withdrawal and trading costs are smaller, but the traded quantities are more significant.

Cryptocurrency Exchanges vs Cryptocurrency Brokers

A broker is a company that buys and sells assets on behalf of their clients. When it comes to cryptocurrency, a broker will usually buy cryptocurrency from an exchange and then sell it to their client at a higher price. If you are looking at crypto brokers vs. exchanges from this aspect, then note that the broker only allows you to speculate on assets’ prices. When choosing a crypto exchange, know that there are only cryptocurrencies or other digital assets you can trade. Clients who prefer to invest directly in cryptocurrencies, have their own assets or hold long positions usually consider using exchange services. Besides investigating which payment methods are offered by a crypto exchange, you should also find out which crypto exchange can be used in your location.

Why You Should Consider a Cryptocurrency Broker

Cryptocurrency investment has never been a hotter topic than it is right now. This is largely because Bitcoin has finally broken out of its long-time trading range and skyrocketed to $50,000 and beyond. The spike in value has undoubtedly made millionaires of many, and has even reportedly — maybe — netted more profits for Tesla than the company’s own electric cars have. For the moment, Bitcoin is a shooting star, and hopeful investors all around the world are looking for the right moment to get involved. Before you can deposit money and begin trading, you’ll need to verify your account, which may have various criteria depending on where you live.

Trading cryptocurrencies

When it comes to customers who want to invest directly in cryptocurrencies, who have their own assets, or who wish to hold long positions, exchange services are usually a good option for their needs. As a first step, determine what currencies you want to trade with and whether you are interested in trading many cryptocurrencies. Often, commissions and fees are simplified on exchanges, and cryptocurrency trading is more affordable. As an example, imagine that you open an account with a cryptocurrency broker and deposit 1,000 USD so that you can sell Bitcoins through it. Your profit comes from the difference in the price at which you withdraw from the trade if the BTC price drops. If the price has dropped from 1,000 USD to 600 USD, you will be able to make a 400 USD profit based on that difference.

It means that you do not receive the difference between making and selling BTC, as we mentioned above. When you make transactions on a crypto exchange, you sell your Bitcoin for whatever fiat is available and make money from purchasing it earlier at a lower price. Unlike currency exchanges, depositing with a broker is a breeze.

With more information about crypto brokerages and crypto exchanges, let’s examine their main differences. Depending on their services and convenience, centralized crypto exchanges may charge higher transaction fees. It could certainly be costly, especially when dealing with larger volumes. The use of CFDs is an alternative to trading Bitcoin, altcoins, or any other crypto asset. In a contract for difference , two parties agree to trade based on a difference in valuations of assets.