Refinancing a mortgage is not a notion that’s advised by banking companies because it’s that loan made to clear away a unique financing.

These businesses bring tough money loans so you’re able to people or industrial property investors who can utilize this financing to end the current loan debts.

#1 In order to secure financing which have a diminished interest.

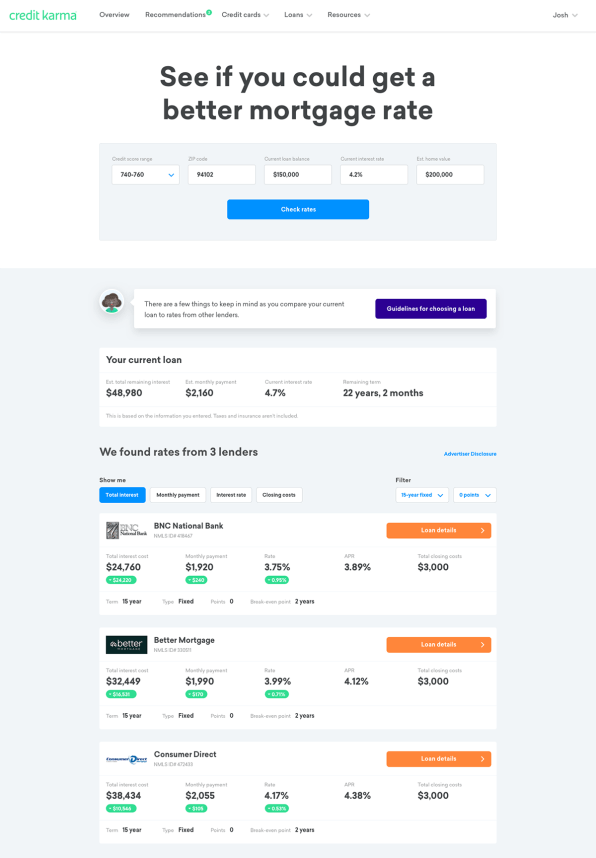

One of the recommended reasons for having refinancing occurs when you wish to reduce the interest rate of your own current financing. Having brand-new fund springing up in the industry, you might find that loan which has less price from attention provide than simply your existing loan. In such cases, refinancing your existing financing for the the fresh new loan is a superb idea. It does somewhat reduce your month-to-month payouts on clearing away from your loan liabilities. Typically, professionals believe that an interest rate decrease of 2% is a great reason why you must know refinancing. Yet not, of several a residential property investors believe that a reduced amount of step one% interest as well is a wonderful cause in order to refinance.

#dos To help you shorten the definition of of your mortgage

2nd wise decision otherwise a situation circumstance is actually refinancing your own old mortgage once you get a hold of financing who has a similar rates of great interest into existing financing. Reducing the lifetime of your loan not simply reduce your full attract profits plus advances the rate at which you are Saybrook Manor bad credit payday loans no credit check going to acquire more collateral on your own property.

#step three To transform a variable Speed Mortgage toward a fixed Financial and vice versa

Variable Price Mortgage loans otherwise Arms generally start out by providing down prices as compared to repaired-rates mortgage loans, but in the future, discover opportunity that pricing of these loans shoot up and eventually get higher than the new fixed-speed home loan bequeath throughout. In such a case, it is best to option and re-finance your Arm to a fixed home loan. Likewise, when you have a predetermined-rates home loan and there was glamorous Possession provided with a steady down interest rate, changing your fixed financial toward a supply can save you a good great deal of money.

2) Link fund

Another version of difficult currency fund was link loansmercial actual home bridge loan lenders are money which can be delivered to link the new monetary gap and supply immediate capital up until a far more long lasting form of financing is established offered.

An informed example to know exactly how bridge loans are once you need certainly to put money into yet another possessions till the sales from your own old property is completed.

In this case, sourcing a link financing is the best method just like the you’re going to be capable get your the brand new property towards the connection loan continues and afterwards pay-off which mortgage pursuing the profit of your dated property is accomplished.

Best-case problems in which link loans make sense:

#step 1 If you want to get a different sort of property before marketing proceeds of an old property is understood

Since informed me from the a lot more than example, this is actually the popular instance circumstances, in which choosing to fund a link mortgage makes the most sense.

#dos When you need working-capital to keep your business afloat up to you are aware new proceeds away from another bargain that is coming the way

It is common to have companies to operate regarding currency that is needed to operate your day to-day surgery of one’s team. Whenever a corporate was relying on an enormous opportunity that’s future its way in months, the business must resource a bridge loan to fund the working capital criteria had a need to contain the organization afloat right up until that it contract happens.