Do you really rating mortgage with the job while worry about-operating? Becoming notice-working function the problem transform some, and you can specialist lenders are a much better choice. If you have a strong trade records and would like to obtain considering yet another price, they’re going to nevertheless read the final several years to help you build a threat testing.

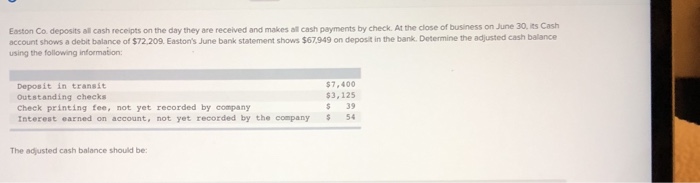

Mortgage lenders might be cagey regarding the credit so you’re able to individuals for the an excellent brand new work because they are required personal loans for bad credit West Virginia in order to provide sensibly, predicated on Uk laws and regulations.

Whenever they are unable to be certain that simply how much you earn per year otherwise how much you’re likely to secure going forward, it may be difficult making a deal.

This alerting ‘s certain mortgage lenders have a tendency to outright refuse any candidate which wasn’t within their present position to own the very least months.

Other people will never be concerned about the duration of your current price considering you’ve been from inside the persisted a position for a lot of many years.

- With only taken to a job with a brand new boss.

- Individuals that altered deals inside the same providers.

- Financial borrowers that have a freshly obtained pay rise.

- People who find themselves going to start work in the next few months.

- People with a contract but are toward probation.

- Pros which have brief-name or short term agreements.

- Experts and you will notice-employed tradespeople that freshly accredited.

Is it possible you get financial that have the latest employment when you yourself have no proof earnings? The best way to go ahead without having good facts of earnings otherwise keeps recently already been a separate part are to do business with an expert broker.

We can strongly recommend loan providers having a certain degree of self-reliance, improve balance of your application, and you may negotiate rates and you can terminology for you.

The newest Employment Mortgages Shortly after Getting a cover Increase

Most of the time, if you have got a wages go up, it can change your financial candidates because your coming earnings often feel large and you will – technically – you might use a whole lot more.

not, that can be less simple for those who feet your home loan value in your the new income but do not have facts instance financial comments otherwise payslips.

How come a different occupations connect with delivering home financing and you may restrict my personal credit well worth? Lenders will reduce amount they lend according to the money they’re able to select on your own files, usually according of one’s regulating legislation i mentioned before.

Some home loan business usually do not constantly package personally on the societal and you can have a tendency to reduce a cover increase as a given provided you have written records.

Do you rating mortgage that have the brand new jobs and you may any files? You can always need a letter from provide otherwise a copy regarding the latest contract evidencing the quantity might secure away from today to the.

Could it be Best to Hold back until Providing a mortgage That have an effective Brand new Employment British?

Oftentimes, it may be smart to waiting six months or so just before you apply for a mortgage, particularly if you might be set on applying to a top street lender or a mainstream home loan company you have caused just before.

If you can’t waiting one to long, need flow household quickly, or simply are not keen on postponing their disperse, we’d suggest getting in touching having help getting a home loan with a brand new job United kingdom.

Although it could be more difficult to find a unique business home loan, particular lenders will approve your loan, constantly for those who have a couple of many years of constant a job history and will promote information on your own right earnings.

Lender Attitudes so you can This new Job Mortgage Applications

Particular mortgage company would be willing to base the home loan provide on your own the latest paycheck, offered you have got a binding agreement page and also at minimum you to definitely bank declaration.