Gateway Financial is an enthusiastic Oklahoma-centered bank which is a part regarding Gateway Earliest financial. The organization has the benefit of multiple mortgage circumstances, as well as fixed-rate mortgage loans, adjustable-speed mortgage loans, FHA funds, Va financing and you may USDA money. The company plus works in the most common of your own You.S.

Portal try known one of Mortgage Manager Magazine’s Finest 100 Mortgage Enterprises about U.S. yearly anywhere between 2012 and you can 2019. From 2013 to help you 2019, the company in addition to seemed with the Inc. Magazine’s a number of this new 5000 Fastest Increasing Private People.

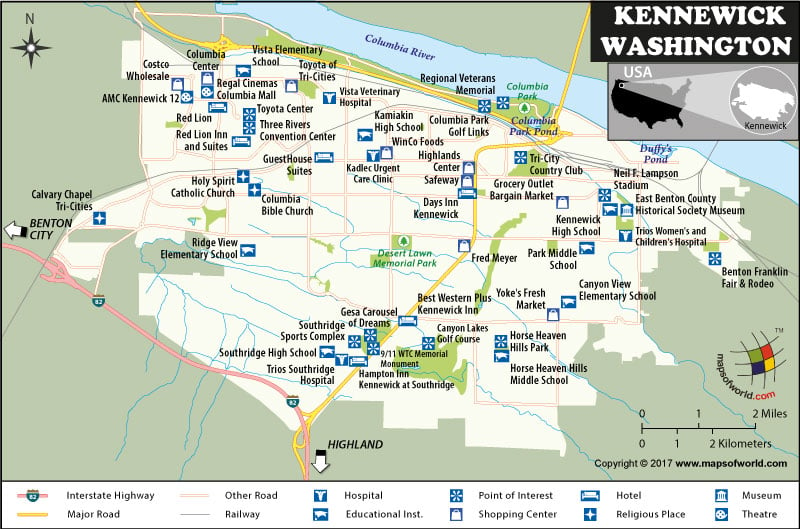

Gateway Mortgage starts fund from the following the 39 claims and you may Washington, D.C.: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Fl, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Nevada, Nj, The new Mexico, Vermont, Kansas, Oklahoma, Oregon, Pennsylvania, Sc, South Dakota, Tennessee, Tx, Utah, Virginia, Washington, Western Virginia, Wisconsin and you may Wyoming.

What sort of Mortgage Should i Get That have Gateway Home loan?

Fixed-rates mortgage: This is actually the most popular kind of home loan readily available. A speed are secured when you look at the at the beginning of the loan and will not transform. Gateway has the benefit of all of them with regards to between 10 and 3 decades.

Adjustable-speed financial (ARM): Which have varying-rates funds, there was a fixed rate for a-flat period of time, after which the pace try sometimes modified. Gateway now offers step 3/6, 5/six, 7/six and you will ten/6 loans. The original matter represents the length of new repaired-rates several months, and also the half dozen designates whenever the costs was modified twice yearly.

Jumbo financing: These really works an identical ways since the old-fashioned finance, but are for big degrees of currency. For 2023, the limitation for a normal mortgage is actually $726,200 for the majority of the country, though it may go doing $step one,089,300 in certain highest-costs parts of the country.

FHA Funds: FHA financing arrive conjunction on Government Construction Management (FHA). Needed only step three% downpayment and are usually open to buyers having quicker-than-sterling borrowing from the bank histories.

Virtual assistant money: Va fund arrive toward backing of You.S. Experts Management to help you pros of the equipped services. There’s absolutely no down-payment requisite and you will rates are often a lot better than having antique money, though there is good Va capital commission.

USDA funds: USDA loans, produced by the new Company from Agriculture, need no downpayment and will feel got that have a minimal credit rating. He is limited in the appointed rural components, even in the event.

So what can You will do On the internet With Portal Financial?

You can apply for a loan on the web having Gateway Financial, definition you may not need to take the problem of getting to your an office meet up with having a home loan broker. You may play with Gateways web site to autopay your loan. This makes it better to make sure you condition around date on your own payments.

Could you Be eligible for a home loan regarding Gateway Home loan?

Portal will not give a direct minimal FICO rating because of its mortgages. But not, usually, a credit history of at least 620 needs to possess a good conventional loan, sometimes fixed or adjustable. Funds having government support could have a lesser FICO rating specifications. As an example, an enthusiastic FHA mortgage might only require the absolute minimum credit history regarding 580.

Having traditional financing, a down-payment of at least step three% is required, in the event this might alter to your a consumer-to-customers basis. Whenever you can gather up at the very least 20% down, you might not you prefer personal financial insurance (PMI), which is important over the business.

What is the Procedure to get a mortgage That have Gateway Home loan?

You can start the procedure by getting preapproved for a financial loan having fun with Portal Mortgage’s website. You can easily upload all your associated records and Portal may find everything you be eligible for loans for bad credit Sherwood Manor CT open today.

After that, you will need to find a property. Once you’ve a home we wish to purchase, you can easily take your pre-approval and work out a deal. The loan is certainly going to help you a keen underwriter to possess final acceptance. As soon as your mortgage is approved, you can close the sale – together with expenses relevant closing costs – as well as have the points.

Exactly how Portal Mortgage Gets up

You should buy the loan possibilities you are interested in from the Gateway Mortgage, along with prominent government-backed programs. If you live in a state in which Portal operates, you may manage to find what you’re shopping for.

Significantly, Gateway possess strong on line devices, for instance the ability to submit an application for a loan to make home loan costs on line. Many quicker loan providers try not to give it, very that’s a primary in addition to on the company.